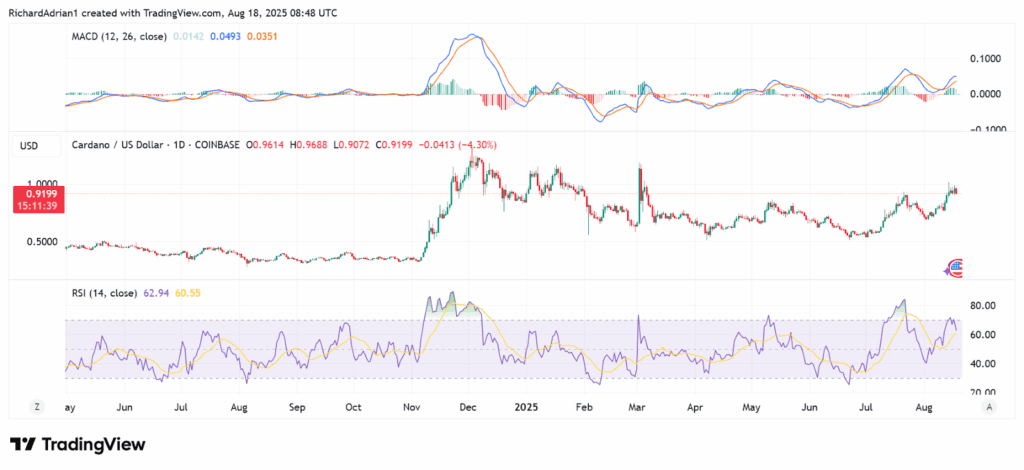

Cena Cardano

v USD

Cardano – informace

Zřeknutí se odpovědnosti

Vývoj ceny Cardano

Cardano na sociálních sítích

Průvodci

Vytvořte si bezplatný účet OKX.

Vložte si na účet finanční prostředky.

Zvolte si kryptoměnu

Cardano – nejčastější dotazy

Jako v případě většiny kryptoměn je cena měny Cardano náchylná ke sledování hlavních cenových trendů na trhu kryptoměn. To znamená, že během býčích cyklů cena měny Cardano roste, a naopak padá v případě medvědích fází.

Kromě trendů na trhu je cena měny Cardano ovlivněna i faktory, jako jsou síťové upgrady a pozitivní či negativní zprávy týkající se sítě.

Jako společnost OKX vám doporučujeme provést si průzkum jakékoli kryptoměny, abyste do ní mohli investovat s objektivním pohledem. Kryptoměna se považuje za vysoce rizikové aktivum, které je náchylné k prudkým cenovým pohybům. Vyzýváme vás proto, abyste investovali jen v případě, že jste ochotni riskovat i ztrátu.

Kromě toho je však Cardano, stejně jako všechny kryptoměny, volatilní a nese s sebou investiční rizika. Proto byste si před investicí měli udělat vlastní průzkum (DYOR) a před pokračováním se rozhodnout, do jaké míry jste ochotni riskovat.

Bitcoin využívá mechanismus pro dosažení konsenzu Proof-of-Work (PoW), který vyžaduje, aby těžaři pomocí počítačů řešili složité matematické problémy, což je energeticky náročný proces. Těžař, který problém vyřeší, se však dostane k ověřování transakcí a k vytvoření bloku a získá odměnu v BTC.

Cardano oproti tomu používá mechanismus pro dosažení konsenzu PoS, jehož energetická náročnost je výrazně nižší. Podle Hoskinsonových odhadů představuje spotřeba energie u měny Cardano 0,01 % spotřeby u bitcoinu. Proto se Cardano někdy označuje jako „zelený blockchain“, přestože se objevilo mnoho konkurentů, kteří o sobě tvrdí, že jsou ještě udržitelnější.

Plán vývoje měny Cardano je rozdělen do 5 fází : Byron, Shelley, Goguen, Basho a Voltaire. Během fáze Byron vyvinul tým Cardano základní kód sítě, v jehož jádru je mechanismus pro dosažení konsenzu Ouroboros – ten uživatelům umožňuje směnu nativního tokenu ADA.

Fáze Shelley se zaměřila na decentralizaci, aby bylo zajištěno, že uzly bude provozovat různorodá skupina lidí, nikoli centralizovaná skupina. V následné fázi Goguen proběhl upgrade Alonzo, při kterém byly do systému Cardano zavedeny funkce pro chytré kontrakty.

Upgrade Vasil v rámci fáze Basho se zaměřil na lepší škálovatelnost sítě zlepšením prostupnosti. Cardano rovněž pracuje na zavedení sidechainů pro další zvýšení škálovatelnosti během této fáze.

Ve fázi Voltaire dojde k přidání hlasovacího a pokladního systému pro autonomní mechanismus správy a řízení (governance). Uživatelům umožní stakovat jejich aktiva a hlasovat o budoucím vývoji sítě.

ADA můžete zakoupit na burze OKX. OKX nabízí obchodovatelné páry ADA/USDT, ADA/USDC, ADA/BTC a ADA/ETH. Případně můžete koupit ADA přímo pomocí fiatu nebo převést vaši kryptoměnu na ADA.

Než začnete na OKX obchodovat, musíte si vytvořit účet. Chcete-li zakoupit ADA pomocí vámi preferovaného fiatu, klikněte pod Buy Crypto (Koupit krypto) na horním navigačním panelu na Buy with card (Koupit kartou). Chcete-li obchodovat s obchodovatelnými páry ADA/USDT, ADA/USDC, ADA/BTC či ADA/ETH, klikněte na „Basic trading“ (Základní obchodování) v části „Trade“ (Obchod). Pro převod kryptoměn na ADA klikněte na stejné kartě na „Convert“ (Převést).

Nebo navštivte naši novou Kalkulačku kryptoměn OKX. Vyberte ADA a požadovanou fiat měnu, kterou chcete směnit, a zobrazí se vám odhadovaná živá cena směny.

Ponořte se hlouběji do Cardano

Cardano (ADA) is a third-generation blockchain platform looking to improve the workings of Ethereum and Bitcoin. Named after Gerolamo Cardano, a 16th-century Italian polymath, Cardano describes itself as a third-generation blockchain equipped with the technologies required to enable a sustainable and secure crypto network.

Like every Layer 1 blockchain project, Cardano also has its native token, which doubles as the consensus anchoring mechanism and a settlement currency. This token is named ADA after a 19th-century mathematician, Ada Lovelace, who developed the first computer algorithm and is regarded as the first programmer.

How does Cardano work?

Cardano is among the first blockchains to be built using the highly secure Haskell programming language. Its multi-layered protocol is capable of performing sophisticated functions, comprising of a Cardano Settlement Layer (CSL), which serves as a unit of account, and a Cardano Computing Layer (CCL), which executes smart contracts and facilitates identity recognition and compliance.

The workings of Cardano boil down to implementing an energy-efficient consensus mechanism called Ouroboros. Ouroboros is a Proof of Stake (PoS) consensus mechanism where users stake their assets to validate transactions. The validators are rewarded with ADA tokens in proportion to their staked assets. This in-house developed technology allows Cardano to use only a fraction of the energy used by legacy blockchains like Bitcoin and Ethereum to validate transactions and keep their networks secure.

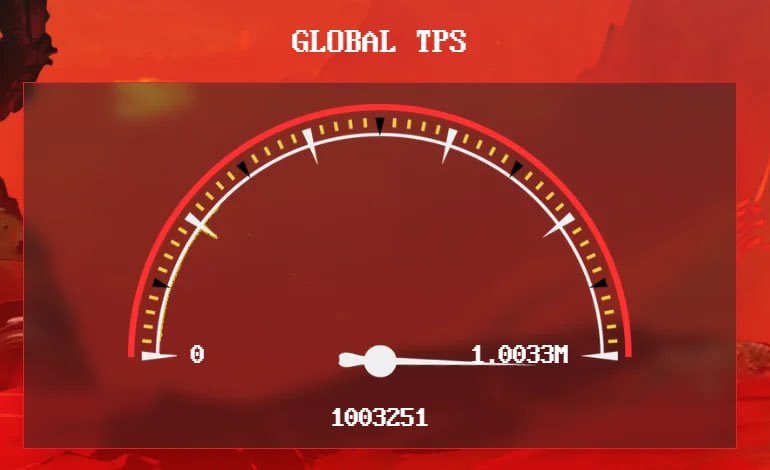

Besides offering an environmentally friendly network, the Cardano blockchain resolves the scalability issues plaguing established blockchains without dialing down on the importance of decentralization. Specifically, Cardano currently processes 250 transactions per second (TPS), a considerably high figure compared to Ethereum's 15 TPS and Bitcoin's 4 TPS. It does this while providing the infrastructure required to develop and launch decentralized applications (DApps). Notably, these functionalities have elevated Cardano's popularity in the crypto community.

ADA tokens are used to pay transaction fees, and users can also stake their ADA tokens to receive ADA-denominated yields. In the future, holders can use their ADA tokens to participate in governance-related processes. When this happens, ADA holders will become the major stakeholders of the Cardano economy and will collectively decide on the future of the blockchain.

Over the years, Cardano has emerged as one of the top ten cryptocurrencies by market capitalization due to its sophisticated blockchain architecture and the endless potential it offers as regards blockchain scalability.

What is Cardano's Alonzo upgrade?

The Alonzo upgrade was one of the most significant enhancements to the Cardano network, adding smart contract capabilities. It was implemented on the Mainnet in September 2021 and furthered its aim of competing with Ethereum, the world's leading smart contract platform. The introduction of smart contracts laid the path for developers to build various applications on Cardano and even mint non-fungible tokens (NFTs), expanding the network's capabilities in the decentralized finance (DeFi) space.

What is Cardano's Vasil upgrade?

Another significant development for the Cardano ecosystem was the Vasil upgrade. Named after Vasil Dabov, a Bulgarian mathematician and former Cardano contributor who passed away in December 2021, the upgrade aims to enhance the network's capabilities. While the upgrade was initially scheduled for June 2022, it was delayed to September 22, 2022, a week after Ethereum, Cardano's biggest competitor, switched to a PoS network.

The Vasil upgrade enhanced Cardano's programming language Plutus, enabling developers to build dApps with greater speed, transactional capability, and powerful scripts. The upgrade also introduced diffusion pipelining, which streamlined the sharing of new blocks with network participants, ensuring that blocks can be shared in the network within five seconds of their creation. The Vasil upgrade was implemented as a hard fork and aimed to enhance the network's throughput and experience for all users.

ADA price and tokenomics

ADA has a max supply of 45 billion tokens, and 34.18 billion ADA tokens were already in circulation by September 2022. Initially, ADA was distributed through an initial coin offering (ICO) in which 25.9 billion ADA tokens were sold in five rounds of public sales for around $79.2 million.

A total of 5.18 billion ADA tokens, or 20 percent of the circulating supply of 25.9 billion, was distributed among the three entities responsible for the development of Cardano. They are Input Output Hong Kong (IOHK), the Cardano Foundation, and Emurgo. IOHK received 2.46 billion tokens, while Emurgo and the Cardano Foundation received 2.07 billion and 640 million ADA tokens, respectively.

Therefore, 31.11 billion ADA tokens were in circulation at Cardano's official launch, and the remaining 13.88 billion ADA tokens were set aside as a reserve to incentivize and reward stakers. The primary distribution mechanism of ADA is its staking mechanism. Like most blockchain solutions, Cardano runs an incentive-based economy designed to encourage participants to contribute positively to the growth and safety of the ecosystem.

Specifically, stakers are rewarded with ADA tokens as part of the mechanisms to encourage users to participate in the transaction validation process. In essence, staking doubles as a token emission system for Cardano as newly issued coins are periodically allocated to successful stakers. This will continue until 45 billion ADA coins are in circulation.

As mentioned earlier, the supply cap of ADA is 45 billion tokens, with approximately 34.18 billion tokens already in circulation. Considering that 31.1 billion ADA was allocated to various entities at the launch of Cardano, it is safe to say that around 2.9 billion ADA has been distributed via the staking mechanism.

About the founders

Cardano was launched in 2017 by founder Charles Hoskinson. Although Hoskinson started researching and building Cardano in 2015, the project and its native token, ADA, did not officially launch until 2017.

Before this, Hoskinson was heavily involved in creating Ethereum as one of its co-founders. He left the project due to differences in ideologies over the future of the network. Hoskinson reportedly wanted to accept venture capital and turn Ethereum into a for-profit project, while Vitalik Buterin wanted to keep it running as a non-profit.

Former Ethereum colleague Jeremy Wood approached Hoskinson soon after, and the two started Input Output Hong Kong (IOHK) in 2015. IOHK is an engineering company that primarily focuses on the development of Cardano while helping to build cryptocurrencies and blockchains for academic institutions, enterprises, and government entities.

In addition to being a contributor to Ethereum, Hoskinson was the founding chairman of the Bitcoin Foundation's education committee. He also established the Cryptocurrency Research Group in 2013.

What makes Cardano unique?

One thing that continues to set Cardano apart is how its development has unraveled via an open-source and peer-reviewed model. Cardano is peer-reviewed, as all of the components that have come together to make up its infrastructure were academically researched by experts around the globe using evidence-based methodologies. As such, it has taken longer than expected for some of the features of Cardano to come to life. This is due to the strict scrutiny that each upgrade must undergo before implementation.

Zveřejnění informací ESG