【半分が当日満期、オプション市場が危険水域へ】

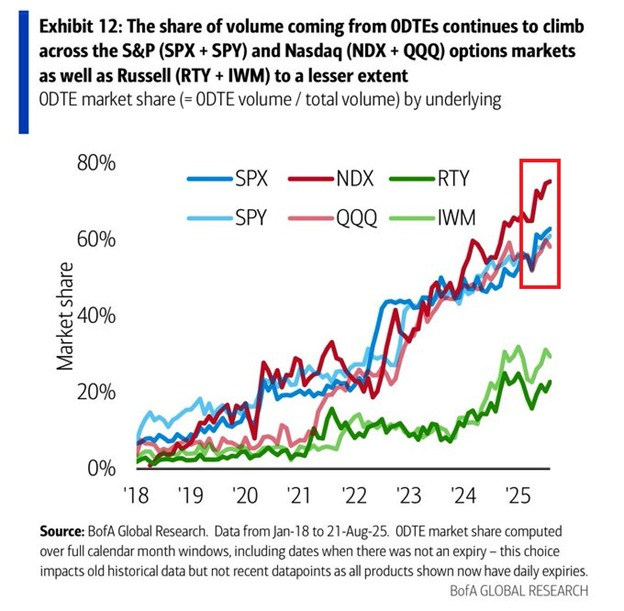

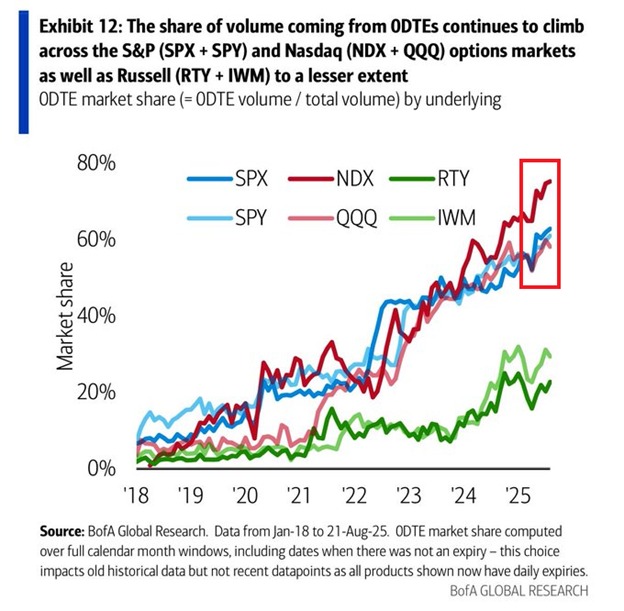

オプション市場の「短期化」が止まらない。

0DTE(当日満期)の比率が急上昇し、米国市場の姿を大きく変えつつある。

ナスダックでは0DTEオプションが取引全体の75%を占め、

わずか3年でシェアは3倍に拡大。

S&P500でも65%と、いずれも史上最高水準だ。

市場は超短期志向に偏り、ボラティリティの急変リスクが急拡大。

「前例のないリスク集中」こそ、いまの相場を映す言葉だと思う。

Shocking stat of the day:

0DTE options now reflect a record 75% of the Nasdaq's total options volume.

This percentage has TRIPLED over the last 3 years.

Furthermore, 0DTE activity in the S&P 500 hit an all-time high, at 65%.

Across the 13 most popular tickers, nearly $2 trillion of notional value has been traded PER DAY in 0DTE options so far in 2025.

For perspective, total US options notional volume averages ~$4 trillion per day.

Investors are taking on unprecedented levels of risk.

27.25K

107

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.