DAI price

in EURCheck your spelling or try another.

About DAI

DAI’s price performance

DAI on socials

Guides

DAI on OKX Learn

DAI FAQ

Dive deeper into DAI

DAI is a decentralized stablecoin designed to maintain a value of one US dollar. It is a product of MakerDAO, a decentralized autonomous organization (DAO) built on the Ethereum blockchain. The project was proposed by Rune Christensen, the founder of MakerDAO, in 2014 to create a stablecoin that was decentralized, transparent, and backed by collateral.

The first version of DAI, called Single-Collateral Dai, was launched in December 2017 and was initially backed only by Ethereum (ETH). Later, the Dai Stablecoin System evolved into a Multi-Collateral Dai system that allows different assets as collateral to back the stablecoin.

DAI has gained popularity as one of the most widely used decentralized stablecoins in the cryptocurrency ecosystem. By being backed by collateral and not pegged to a fiat currency, DAI can maintain its value stability while being transparent and accessible to everyone.

Unlike traditional stablecoins, such as Tether (USDT) and USD Coin (USDC), which are backed by fiat currency reserves, DAI is backed by collateral. Specifically, it is supported by Ethereum and other ERC-20 tokens deposited into a smart contract called a collateralized debt position (CDP).

The value of the collateral is maintained at a minimum of 150% of the value of the DAI that is issued. This ensures that there is always sufficient collateral to back the stablecoin and maintain its stability.

How does DAI work

The technology behind DAI is complex but can be broken down into several key components. The first component of the DAI technology is the CDP smart contract. This smart contract is used to collateralize assets to back the DAI stablecoin. Users can deposit Ethereum and other ERC-20 tokens into a CDP and receive DAI in return.

The value of the collateral is maintained at a minimum of 150% of the value of the DAI that is issued. This ensures that there is always sufficient collateral to back the stablecoin and maintain its stability.

The second component of the DAI technology is the stability mechanism. The stability mechanism is designed to ensure that the price of DAI remains stable at one US dollar. If the price of DAI rises above one US dollar, then the MakerDAO system incentivizes users to create more DAI by lowering the interest rate on CDPs.

If the price of DAI falls below one US dollar, then the MakerDAO system incentivizes users to buy back DAI by raising the interest rate on CDPs. This mechanism ensures that the price of DAI remains stable over time.

The third component of the DAI technology is the governance system. The governance system is used to manage the MakerDAO platform and make decisions about its future. Anyone who holds the DAI governance token can participate in the governance system.

The system is designed to be decentralized and transparent, with voting rights weighted by the amount of DAI each user holds. The governance system is responsible for making decisions about changes to the platform, such as adjusting the stability mechanism or adding new collateral types.

The final component of the DAI technology is the Ethereum blockchain itself. DAI is built on top of the Ethereum blockchain, which provides a secure and decentralized platform for creating and managing the stablecoin. The Ethereum blockchain stores the smart contracts that power the DAI system and executes transactions between users.

What is DAI used for

The DAI stablecoin is used for various purposes in the cryptocurrency ecosystem. One of its most significant use cases is as a medium of exchange. It can be used to buy and sell goods and services like any other currency. Additionally, it can be used as a store of value, as its price stability makes it an attractive alternative to volatile cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

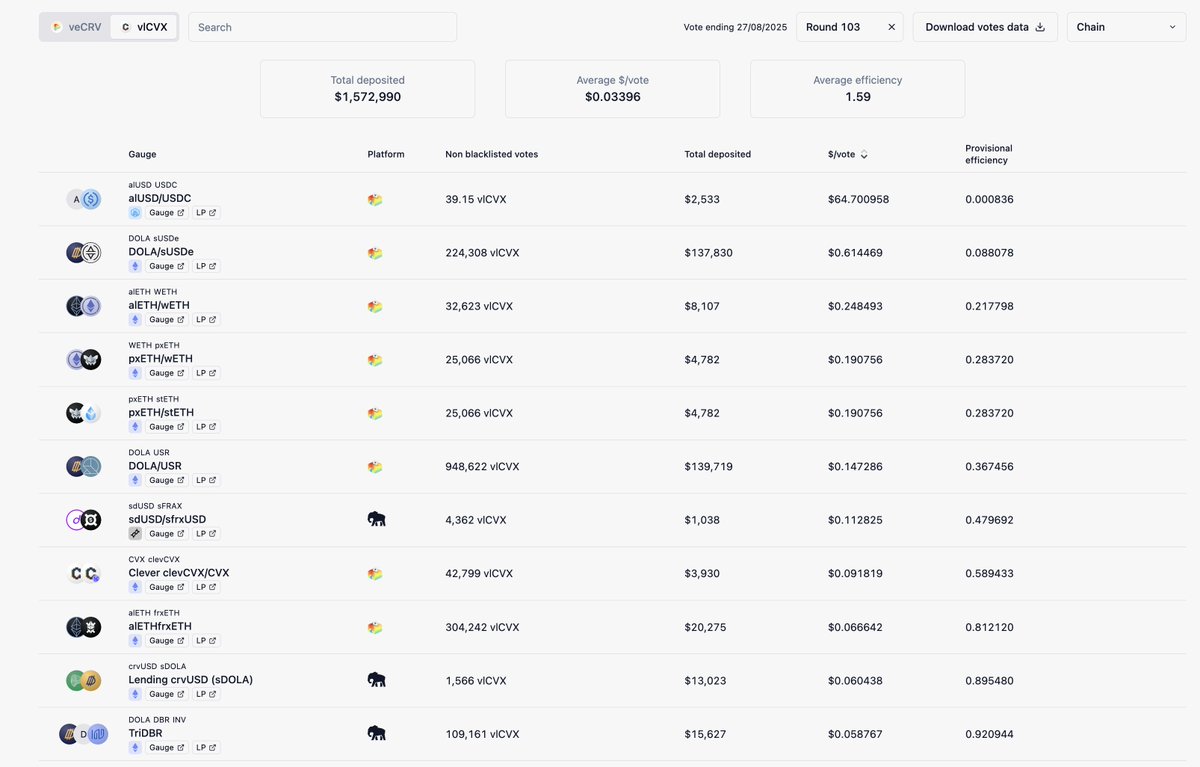

Another critical use case for DAI is accessing decentralized finance (DeFi) applications. DeFi is a new and rapidly growing field that uses blockchain technology to create financial applications that are decentralized, transparent, and accessible to everyone.

Many DeFi applications use DAI as a stablecoin because it offers a stable value that is not subject to the volatility of other cryptocurrencies. As a result, DAI is used in various DeFi applications, including lending, borrowing, and trading.

The DAI token itself is used to govern the MakerDAO platform. Holders of DAI can participate in the MakerDAO governance system, allowing them to vote on proposals and make decisions about the platform's future. The governance system is designed to be decentralized and transparent; anyone can participate by holding DAI tokens.

About the founders

The founders of MakerDAO are Rune Christensen and Andy Milenius.Rune Christensen is the CEO and co-founder of MakerDAO. He has a background in design and entrepreneurship, having previously founded a web development and design agency. Christensen has been the driving force behind the creation of DAI and the MakerDAO platform.

Andy Milenius was the CTO and co-founder of MakerDAO. He has a background in software engineering, having previously worked at Google and several startups. Milenius was responsible for the technical design of the MakerDAO platform, including the development of the smart contracts that power the system. Milenius left the company in 2019.

The MakerDAO team has created a revolutionary stablecoin backed by collateral and designed to maintain a stable value of one US dollar. The team has a deep understanding of blockchain technology and has been working on the concept of a decentralized stablecoin for several years.

The MakerDAO team is highly respected in the blockchain community and has received several awards and accolades. Additionally, the MakerDAO platform has been recognized as one of the world's most innovative and impactful blockchain projects.

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.