Cardano Futures Volume Reach $6.96B as Experts Set ADA Price Target at $1.1

Key Insights:

- Cardano futures hit $6.96B volumes.

- A top analyst said that the next Cardano price target is at $1.49.

- Soaring past the $0.93 mark could push ADA price to new highs

Growing Cardano futures volumes and overall derivatives data support a bullish thesis pointed out by expert traders and analysts that ADA/USD is headed for $1.1.

Cardano exploded to second position on Grayscale’s list of the Top 10 Crypto Assets by Weekly Returns. Cardano price recorded a staggering 17.7% gain between August 9 and August 15.

According to insights on Glassnodes, futures volumes on Cardano surged to $6.96B. It’s a multi-month high that was last witnessed in March.

Here, we explore more about the growing derivative volume and other factors that could influence Cardano’s price rally to $1.1.

Cardano Futures Hit $6.96B Volumes

As per a recent post on X by analyst Ali Martinez, futures volumes for Cardano reached a 5-month high of $6.96 billion. It reflected increased trading activity across the chain. For a long time, ADA’s volumes have floated between $1 billion and $4 billion. This makes the recent jump steep and bullish.

Across derivatives data on CoingGlass, retail traders are skewed towards longs. The same suggested a strong positive indicator for incoming bullish momentum.

However, the longs have taken deeper liquidation hits because traders are strongly optimistic, which has led to more overleveraged positions.

Notably, a breakout is forming below the $1 price level, with a triangle shared by Ali_Charts indicating there is a heavy possibility of testing $1.1 in the near term.

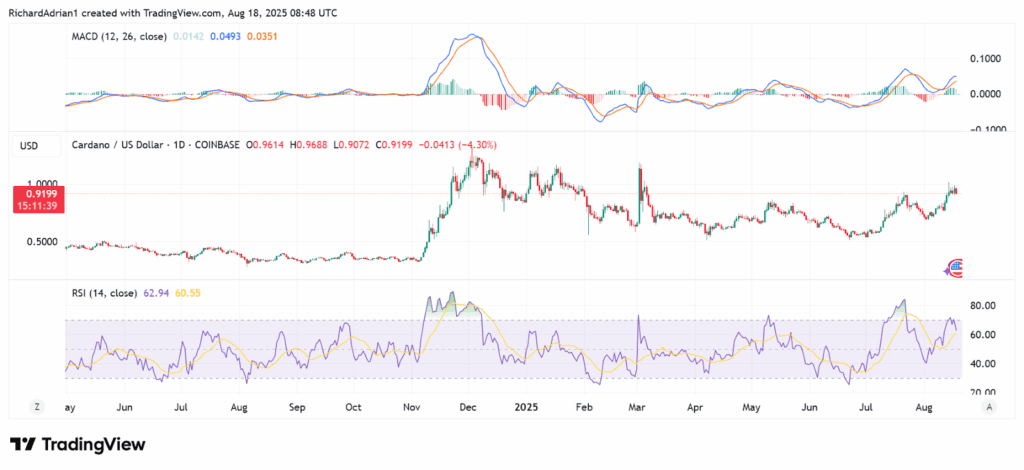

At the time of writing, ADA price is trading at $0.9169. Buyers are adamant to beat the psychological resistance at $1. The technical setup is positive. It suggested the potential to rally past the current price point with the Relative Strength Index (RSI) reading at 62.

At the same time, the Moving Average Convergence Divergence (MACD) also flashed a positive buy signal on the 1-day chart with green bars mirroring the start of an uptrend.

Next Cardano Price Target at $1.49, Says TheDappAnalyst

Cardano’s price is consolidating heavily within a symmetrical triangle. This could see the price reach an upper target of $1.50 if the setup successfully plays out. This is according to an analysis shared on X by expert trader and analyst The Dapp Analyst.

As per the trader, important price levels to watch for include $1.11, $1.29, and $1.49, which are derived based on the Fibonacci extension levels 1.618, 2.618, and 3.618, respectively.

In the event of a pullback and increased sell pressure around $1, the current support could adjust lower to the 61.8% Fibonacci retracement level at around $0.77. Previously, the $0.77 was a crucial resistance that buyers were optimistic about flipping into a support level. As we speak, the current support lies at $0.88.

Meanwhile, if TheDappAnalysts’ assessment substantiates, we are likely to see a major breakout. He said that historically, symmetrical triangles have often resulted in upsides.

A recent assessment of ADA/USDT on the 1-day chart pointed to $0.90 as the ideal entry point and highlighted the 0.93 price level as a crucial launch zone for Cardano’s price to break above $1. As per TurboBullsCrypto, a successful retest of the $0.93 level would have ADA primed for a major move higher targeting $1.13.

Meanwhile, Cardano remains the highest gainer of the week among the top ten list of the largest cryptocurrencies by market cap. Over the last 7 days, Cardano’s price increased by 22.92% surpassing BNB and Tron (TRX), which were the only gainers of the week.

The post Cardano Futures Volume Reach $6.96B as Experts Set ADA Price Target at $1.1 appeared first on The Coin Republic.