From the perspective of traditional finance, how should one allocate cryptocurrency assets?

Today, let’s have Surf deeply think about the allocation of cryptocurrency assets from the perspective of traditional finance, and here are the conclusions:

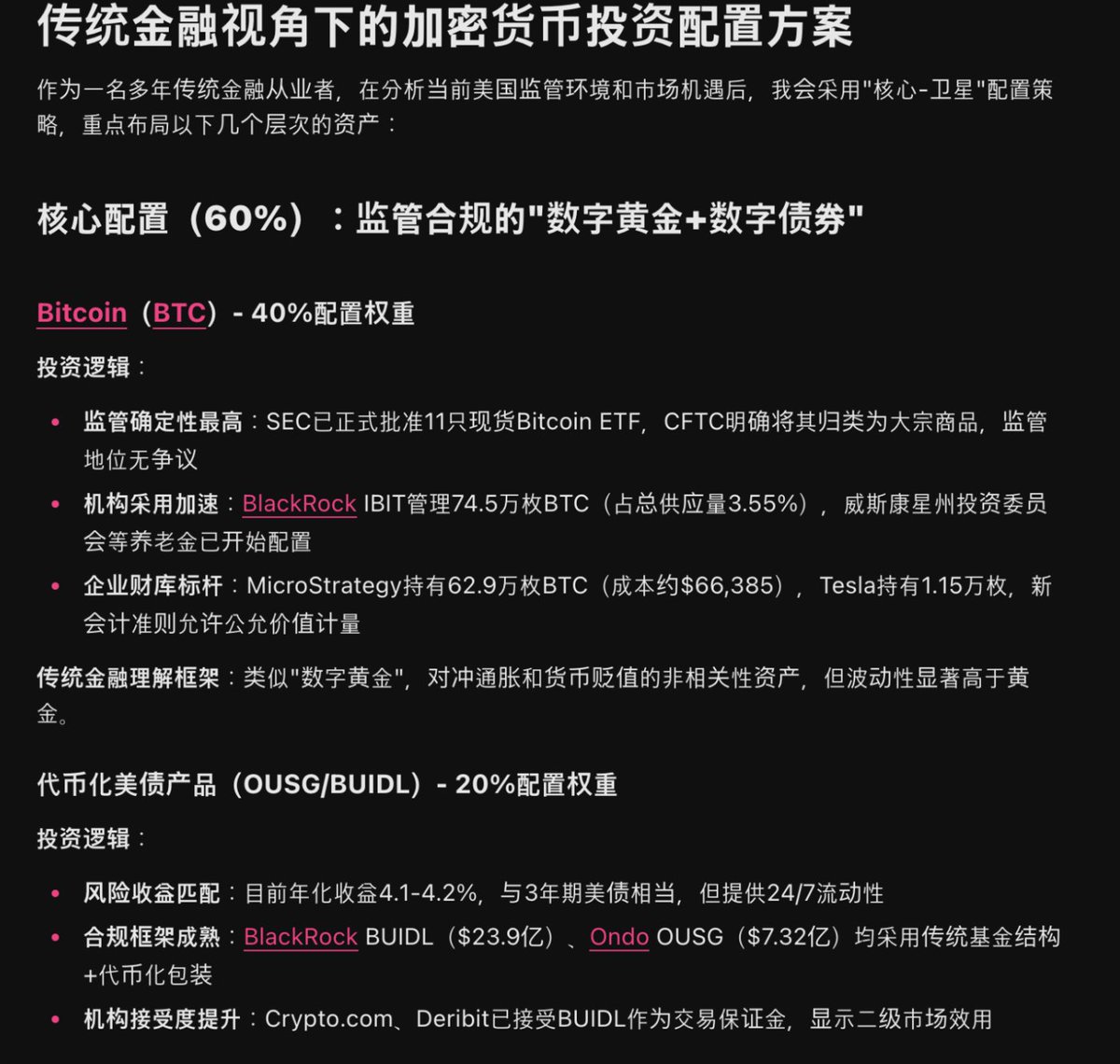

First, BTC is definitely the foundation, with Surf suggesting a 60% allocation. Next is tokenized U.S. Treasury bonds, mainly considering the convenience of 24/7 liquidity (this is something I hadn’t thought of);

The remaining 30% is allocated to high-certainty infrastructure assets, with a preference for those already confirmed as commodities by the CFTC, such as ETH and LINK, aside from CIRCLE. Another 10% is for easily understandable emerging opportunities, such as ONDO and ARB.

Investment approach: compliance first, considering liquidity, with allocations not exceeding 10% of the total investment portfolio, using a regular investment strategy to smooth out price fluctuations.

Show original

34.31K

10

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.